Individual Bonds vs. Bond Funds: What’s the Difference?

个人债券和债券基金都可以提供收入来源, but there are important differences. 单个债券比基金提供更多的确定性和稳定性, 虽然基金可以提供分散投资的机会,但这可能很难从单个债券中获得.

Coupon, maturity, and yield

每只债券都有票面利率(按债券面值支付的年利率)和到期日, 哪一天是本金归还给借款人的日子. If you hold a bond to maturity, 你将在持有期间收到到期的利息(通常每季度或每半年支付一次)和到期时的全部本金, unless the bond issuer defaults. 如果你在债券到期前在二级市场出售, you will receive the market price, 哪个可能高于或低于票面价值或你支付的金额, depending on market conditions.

By contrast, 债券基金没有票面利率或到期日(某些定期基金除外). 基金通常根据基金中的债券按月支付股息. 利率会随着债券的更换而变化(由于到期或出售), and as market conditions change. A fund also has fees and expenses, which reduce the interest paid, 基金经理可以通过各种方式来适应市场状况, depending on the fund’s objective. Because there is no maturity date, 只要基金公司继续营业,你就可以持有基金. However, 无论你持有股票多久,都不能保证你会收到本金. 基金股份,当出售时,可能比你的原始投资价值更高或更低.

收益率是基于利率和购买价格的债券或债券基金的预期收益. 如果你以票面利率4%的票面价值购买1,000美元的债券,收益率就是4%. 但如果你在二级市场上以800美元买同样的债券, the yield is 5%, 因为你会根据票面价值获得利息:4% x 1美元,000美元面值= 40美元利息/ 800美元购买价= 5%收益率. Bond fund yields are more complex, 但30天的美国证交会收益率(或标准化收益率)提供了一个有益的比较. 这通常是使用该月最后一天的最高股价来计算的,并假设它与前30天保持相同,预计年度净投资收益.

Varied Performance

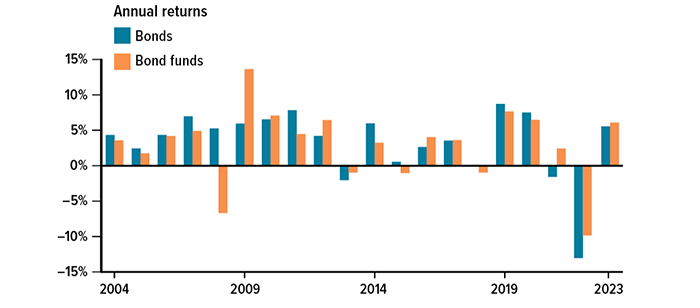

过去20年,个人债券和债券基金的表现有所不同. In part, this is because fund managers may respond to the market in different ways; for example, 他们可能试图保持收益高于股价,反之亦然. 请注意,单个债券的表现仅适用于二级市场的价值, not to bonds held to maturity.

资料来源:伦敦证券交易所在线赌场排名首页,2024年,2003年12月31日至2023年12月31日. Bonds are represented by the Bloomberg U.S. 总债券TR指数和债券基金由Thomson US: All Gen Bond - MF指数代表. 不考虑费用、费用、收费和税费. 非管理指数的表现并不代表任何特定投资的表现. Individuals cannot invest directly in an index. 回报率会随时间变化,尤其是长期投资. 追求更高回报率的投资涉及更高程度的风险. Past performance is no guarantee of future results. Actual results will vary.

Interest rate sensitivity

债券和债券基金对利率的变化很敏感. Generally, when rates rise, 现有债券和债券基金的市值下跌, because newly issued bonds pay higher interest rates. 相反,当利率下降时,现有债券和债券基金的市场价值就会上升. 这只适用于市场价值,不会影响持有至到期的单个债券.

如果你在美联储大举加息期间持有债券基金, 当你看到自己的股票价值下跌时,你可能会感到沮丧. Now that interest rates seem to have stabilized, share values are likely to stabilize as well, and they may increase if rates begin to decrease. 债券基金通常会在相关债券到期时取代它们, 过去两年新发行的债券通常会支付更高的利率, increasing the interest paid by the fund. 虽然无法预测未来的市场走向, 如果利率保持稳定或开始下降,债券基金可能会提供可观的回报.

分散投资并不能保证盈利或防止投资损失. Funds are sold by prospectus. 请在投资前仔细考虑投资目标、风险、收费及费用. The prospectus, 里面有这个和其他关于投资公司的信息, can be obtained from your financial professional. 在决定是否投资之前,一定要仔细阅读招股说明书.